Here’s how Tesla could wake Bitcoin’s sleeping bulls

Bitcoin (BTC) has been locked in a relentless struggle, teetering above and below the $26,000 mark over the past few weeks.

Yet, a glimmer of hope emerged on September 14 when reports broke out that BTC achieved a significant milestone, which could pave the way for the cryptocurrency to regain its status as a payment option at Tesla (NASDAQ: TSLA), bringing a fresh wave of optimism to the crypto community.

What happened?

First, let’s rewind a bit.

In February 2021, Tesla disclosed a $1.5 billion investment in Bitcoin “to further diversify and maximize returns on” its cash reserves. In addition, the world’s biggest electric carmaker announced its plan to begin accepting BTC as a payment method, making it the first major auto manufacturer to do so.

However, the hype was short-lived. Just a few months later, Elon Musk’s Tesla made a U-turn and said it would suspend vehicle purchases using BTC, citing worries over the rising use of fossil fuels for Bitcoin mining and trading.

“Tesla has suspended vehicle purchases using Bitcoin. We are concerned about the rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

– the company stated at the time.

Notably, Musk then said that Tesla would restart Bitcoin payments after BTC miners’ clean energy use outstrips 50%. Remarkably, this condition has now been reportedly met, potentially marking a pivotal moment.

Bitcoin clean energy usage is now over 50%

On Thursday, September 14, Bloomberg analyst Jamie Coutts revealed in an X (Twitter) thread that the percentage of Bitcoin mining energy stemming from renewable sources had exceeded 50% due to “falling emissions plus a dramatically rising hash rate.”

The move comes after Bitcoin miners started fleeing China following the nation’s ban on mining in 2021. Furthermore, other countries forayed into crypto mining to “monetize stranded and excess energy,” the analyst added.

What does this mean for BTC price?

Well, it is still too early to come to conclusions. Still, if Elon Musk brings back BTC payments thanks to growing clean energy use, it could result in a fresh surge in bullish pressure in the leading crypto asset, particularly among institutional investors.

But regardless of Musk and Tesla, Bitcoin’s clean energy usage exceeding 50% nevertheless represents a significant milestone for the digital asset as it could garner the attention of other environmentally-friendly investors and companies.

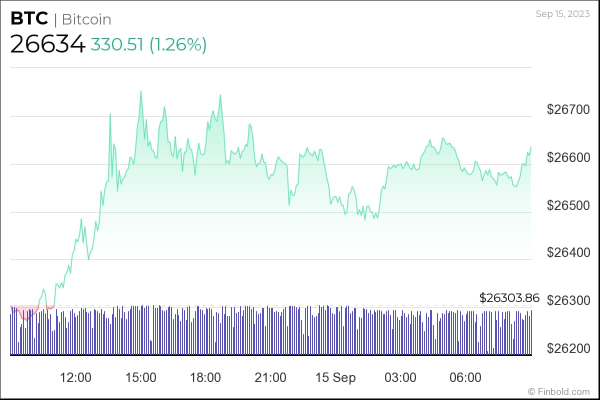

At the time of writing on September 15, BTC was changing hands at $26,634, up 1.3% in the past 24 hours.

The cryptocurrency advanced 1.7% on the weekly chart while losing almost 10% on the month. Year-to-date, its gains remain strong at over 60%.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.